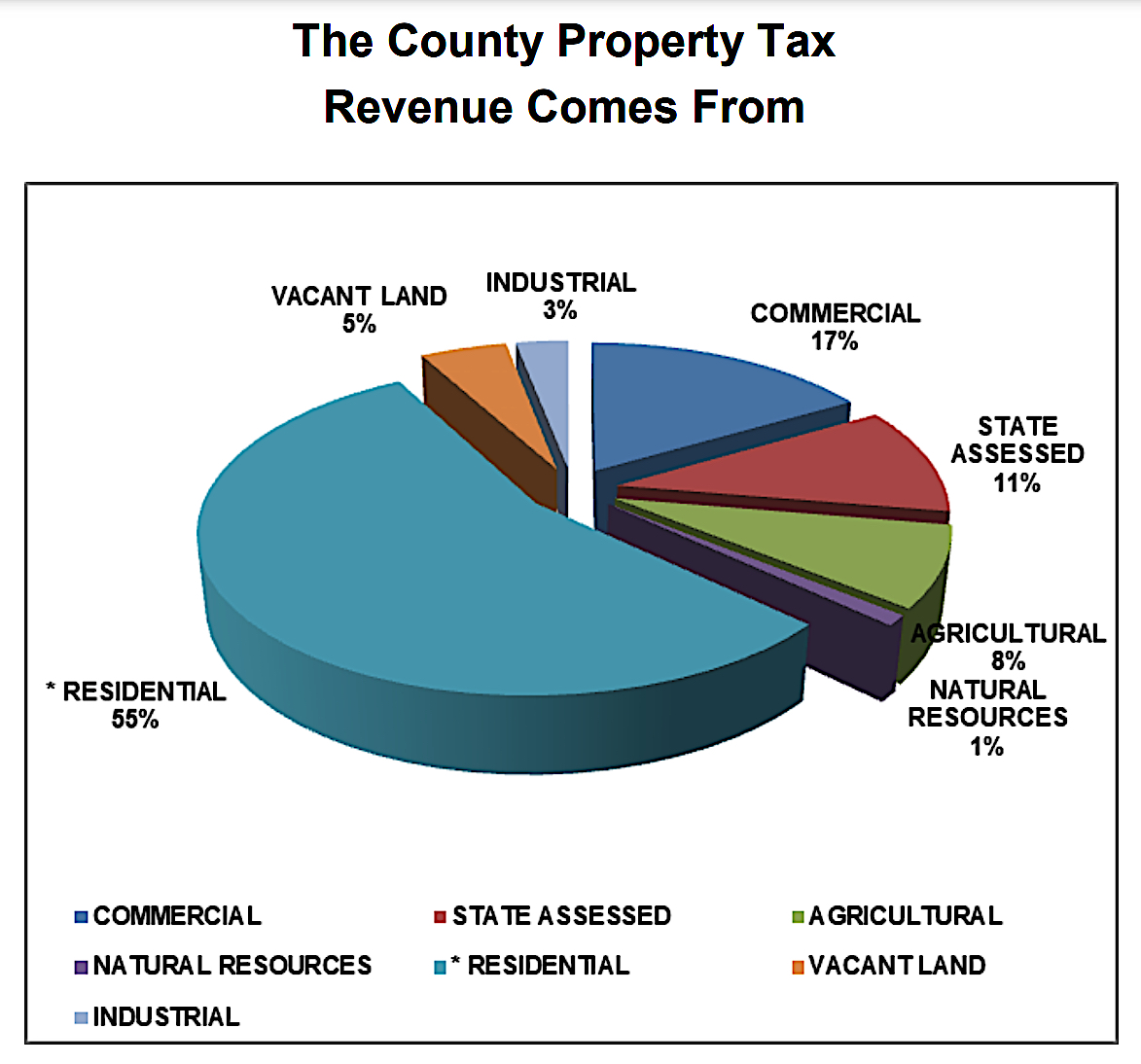

Actual value of the taxable property in Delta County is $3,591,167,788 and the total assessed value is $377,918,331.

Actual value of the taxable property in Delta County is $3,591,167,788 and the total assessed value is $377,918,331.

This is a drop in assessed value by $3,397,346 compared to 2021. The reduction is due to lowered rates assessed for residential and agricultural property. This translates to a net loss of about $52,075 in tax revenue.

READ THE FULL REPORT — http://www.citizenreport.info/…/Assessor_report_2022.pdf