Delta County Commissioners, administration and staff department heads have begun developing the 2018 county budget.

Citizen Report will cover the budget process in a series of stories designed to help the community understand what’s involved in developing a county budget and, hopefully, add insight into how our taxpayer’s dollars are being used.

We begin the series with a brief overview of the 2016 audit, an independent report, done by Blair and Associates, PC, designed to review county accounting processes and provide an overview of the county’s financial activities and health.

The 95-plus page report also goes a long way toward helping the public understand how our county’s budget is structured, how revenue is generated, where investment is allocated, how money moves within the budget, and how assets are valued.

Here are some of the highlights and notables:

Delta County’s assets exceeded liabilities by $157.6 million at the end of 2016.

- $15.4 million may be used to meet the government’s ongoing obligations to citizens and creditors.

- $139.2 million is invested in capital assets

- Law restricts $3 million and includes Tabor reserve

Total operating revenues in 2016 were $22,109,661 and total operating expenses were $22,286,346 resulting in a decrease in the county’s net assets by $176,685. Despite last year’s budget loss, Delta County remains in the black — as it has for many years — because funds are kept in reserve and are carried over from year-to-year.

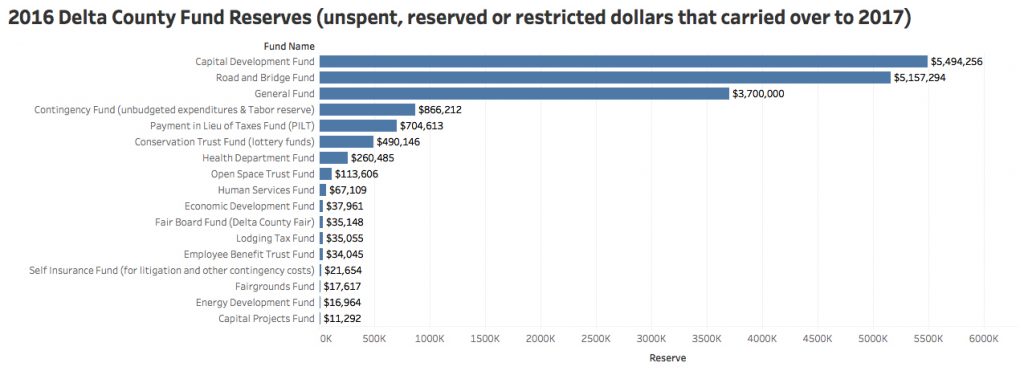

Delta County maintains 17 individual governmental funds for day-to-day operations. At the end of 2016 each fund ended with positive balances totaling $17.6 million, 83% of which is unrestricted.

The graph below details these funds and their ending balances in 2016:

Fund notes:

- Road and Bridge Fund had a $5,157,294 reserve, $2 million, of which, is reserved for gravel inventory

- Capital Development Fund is funded by 75% of a one percent county sales tax and is restricted to capital projects.

- Conservation Trust Fund is lottery funds and is restricted to recreation projects on publicly owned land. Note, this fund has maintained a large reserve over, at least, ten years.

- Payment in Lieu of Taxes Fund or PILT are federal payments to local governments that help offset losses in property taxes due to non-taxable Federal lands within their boundaries

Delta County maintains two proprietary funds for their business operations: Emergency 911 and the county’s landfill. These funds are labeled as “enterprise funds” since they represent county operations with private business-type activities. At the end of 2016, each fund ended with positive balances totaling $1,498,935.

Read the entire audit: County_Audit_16

3 thoughts on “BLOG #1 — 2018 COUNTY BUDGET SERIES: Independent Audit Shows County in the Black”

Comments are closed.